Donation Receipts Samples

Sending a follow up thank-you email immediately after a donation has been made. 34 Samples Free Templates Receipt Templates.

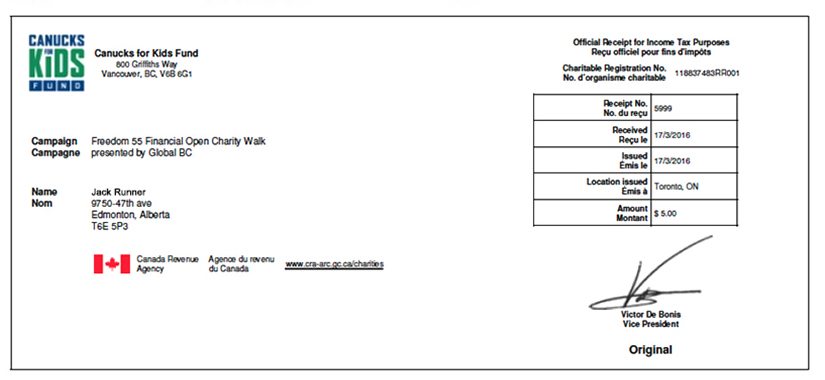

Temporary Official Tax Receipt Formats And Requirements Running Room Support

FREE How to Write a Captivating Recommendation Letter for Employment Helpful Tips FREE 6 Thank-You Letters for References and Recommendations in PDF MS Word Pages Google Docs.

. Maintaining your own vehicle if you use your car or truck for business travel. However this gross sales number is before any deductions are made to give a fuller picture of. Easy preparation of a financial statement.

It is received after paying tuition fees library fees and miscellaneous fees. Receipts are used for record-keeping by both the seller and the buyer. Note that registered charities issue other forms of receipts to acknowledge acceptance of services or items that are not gifts.

For Q3 a businesss receipts show it sold 50000 total units at 100 per unit. The PDF file itself is not editable. Finally if the individual who made a donation and received goods and or services in exchange for any donation over 75.

Sample Church Donation Receipts. The process of handling customer complaints will depend on the complaints grounds and the level of authority needed to supply a resolution. It shows proof of a money transaction.

FREE 7 Coworker Recommendation Letter Samples in MS Word Pages Google Docs PDF. 54 Free Receipt Templates How to Make a Receipt in Word. Easy preparation of tax returns.

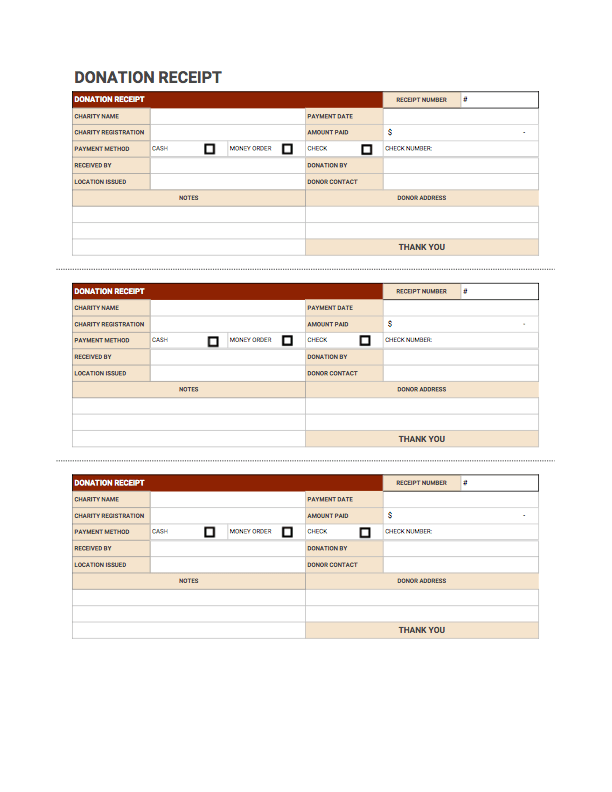

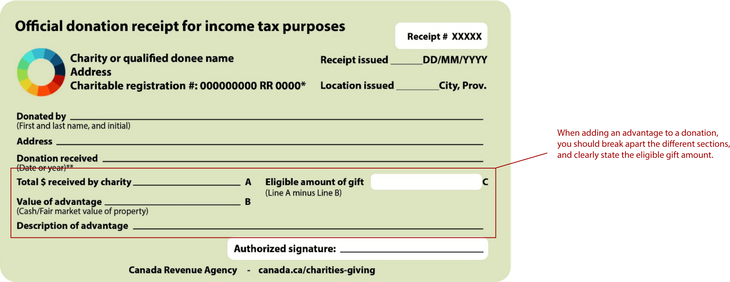

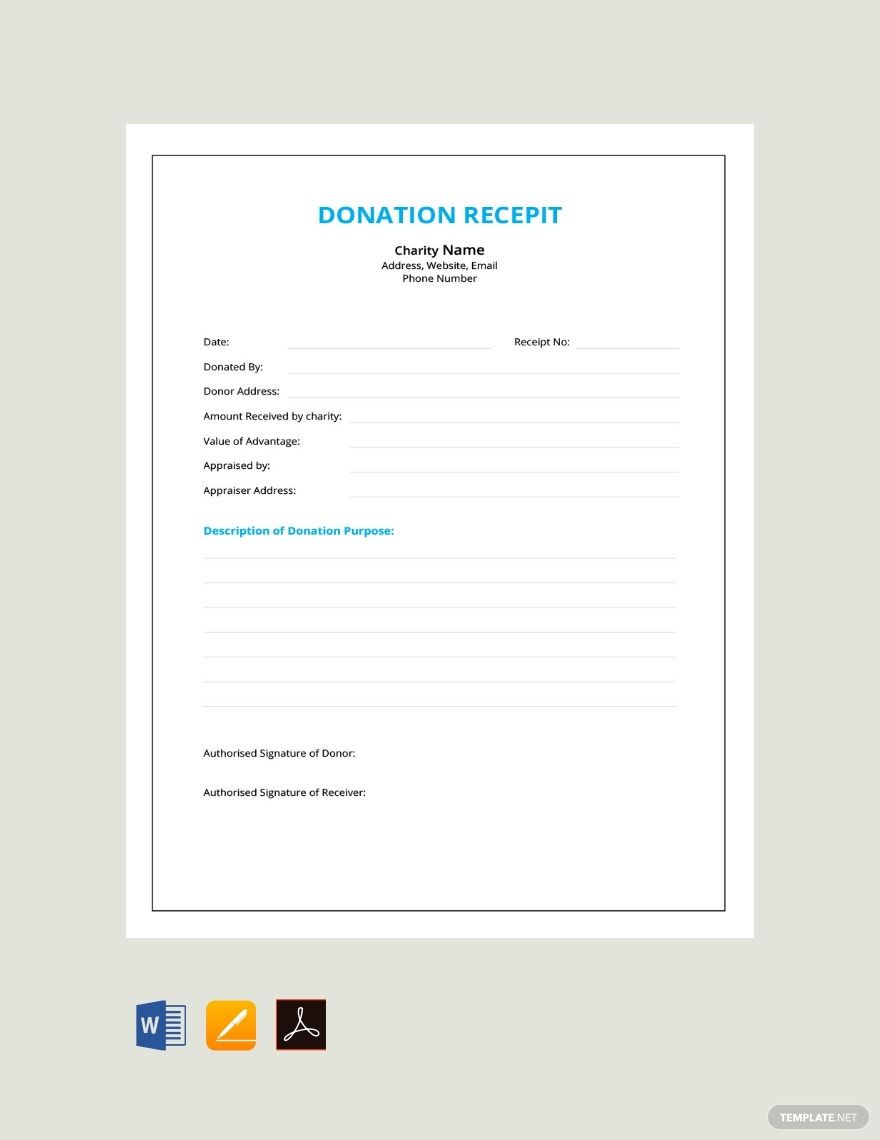

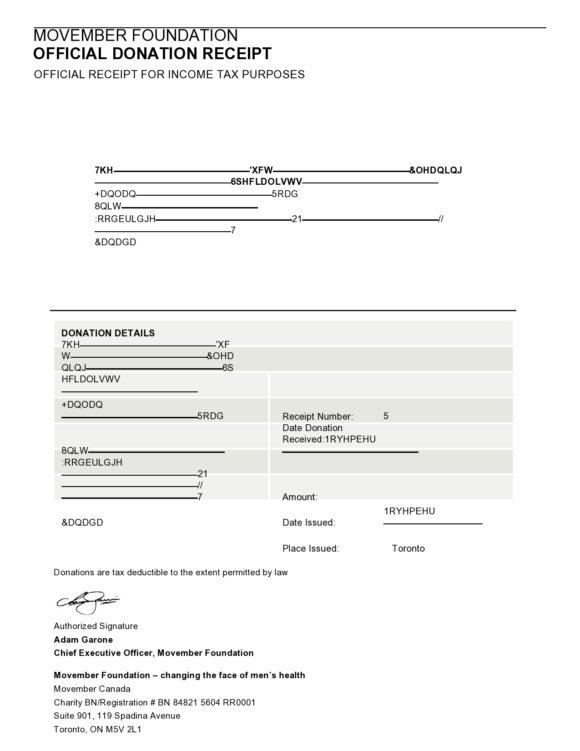

Since there is not a specific form to use a donation receipt many churches create their own letter or statement to be used as proof of receiving a donation. But dont just follow any random template because you should follow samples that observe professional standards too. Registered charities and other qualified donees can use these samples to prepare official donation receipts that meet the requirements of the Income Tax Act and its regulations.

Select download and edit your chosen sample. This letter of support is to confirm that I Your Name will be providing full financial support to Name of the beneficiary during your reason for offering your support until a time when period so heshe does not become a financial burden. IRS regulations govern what documentation donors need in order to claim a deduction for their charitable contribution.

Verify procedures - After finding a location in your area that has the program verify how their sign-up procedures work as well as the time frame during which applications are accepted. The cash registers drawers are where cashiers store the coins and bills for the day. Some different types of school fee receipts are.

In 2008 candidates for office political parties and independent groups spent a total of 53 billion on federal elections. The IRS website provides a comprehensive section on gift substantiation. It is helpful for fundraising activities.

Donation receipts are also required when one individual donation adds up to 250 or more. The amount spent on the presidential race alone was 24 billion and over 1 billion of that was spent by the campaigns of the two major candidates. This is a versatile form that can be issued at any point in time where it may be needed.

Meals and overnight lodging. These elements play a significant role in conducting your daily cash reports. When reporting its gross sales the business can report 5 million.

And that is just what the enlisted sample vehicle sale receipts above can offer for you. FREE 36 Payment Letter Formats in MS Word Google Docs Pages PDF. You may be able to find this information on the local groups website or you may need to ask via a phone call.

Contributions of services. Open the PDF file using Adobe PDF reader or your web browser. By reviewing the settlement report you can understand your account activity.

You can choose between deducting actual expenses or taking the standard mileage rate. This type of receipt helps in keeping track of deliveries. The council will require the customer or the complainant to fill out a council customer complaint.

These are not tax receipts and should be clearly distinguished from the tax receipts issued to acknowledge gifts. Benefits of Using a Receipt. There are no magic words that each nonprofit must.

Most programs close early in October or when capacity has been reached. Shipping items such as samples or display materials. Date Your official Address Address of the organizationperson you are writing to Dear SirMadam.

To view sample receipts see Samples - Official donation receipts. This element means you need to record all the cash placed in the register at the beginning and end of your. The Return Check Letters 2 Samples are available to download and customize for free for your specific church or organization.

An invoice and a bill are documents that convey the same information about the amount owing for the sale of products or services but the term invoice is generally used by a business looking to collect money from its clients whereas the term bill is used by the customer to refer to payments they owe suppliers for their products or services. Prompt and thoughtful gift acknowledgments are central to effective fundraising. With the Qgiv fundraising platform your organization can customize email receipts based on how the donor gave so that your donor who chose to cover processing fees or to dedicate their donation gets shown appreciation for those extra steps as well.

The receipts do not have to be exactly as shown but they must contain the same information based on the following four types of gifts. You can open the settlement report in a text editor or you can use a spreadsheet program such as Microsoft Excel to. Click here for the Cash Receipts and In-Kind Donation forms.

They didnt start from scratch. This is another example of the donation-in-kind template form. To use the document download it to your local computer.

Sample 1 Cash gift no advantage. People donate and specify their donations market value after which the church uses its discretion in what to. This PDF file features three sample letter templates that you can customize and use to write an appeal for a medical case.

Receipts Templates Designs Documents Choose a Professional Receipt Template. To prepare an accurate tax return. The council members of a state or country are one of the busiest people when it comes to dealing with everyday complaints.

If you are the person responsible for generating receipts consider using one of. Receipts ease the work of making financial statements at the end of the day month or even end of a financial year. What should a thank you to donors include.

Find Fillable Samples and Modify the Business Name Logo Contact Information Date of Sale Products Services Sold Price Discount Coupons Tax and Total Amount Paid. Different types of school fee receipts. Barack Obama spent 730 million in his election campaign and John McCain.

They simply followed a template. Become A Pro Member. You may deduct only 50 of the cost of business meals.

Click here for the Gift Acceptance Policy. How to view Amazon Pay reports in Seller Central length. Click here for Contribution Sample Policies.

Donation Receipt Template Pdf Templates Jotform

Donation Receipt Free Downloadable Templates Invoice Simple

Nonprofit Donation Receipts Everything You Need To Know

Free Donation Receipt Templates Silent Partner Software

Donation Receipt Template Excel Word Apple Pages Pdf Template Net

Donation Receipts Statements A Nonprofit Guide Including Templates

Free Donation Receipt Templates Samples Word Pdf Eforms

Required Information On Tax Donation Receipts

30 Non Profit Donation Receipt Templates Pdf Word Printabletemplates

Comments

Post a Comment